Best Online Small Business Loans

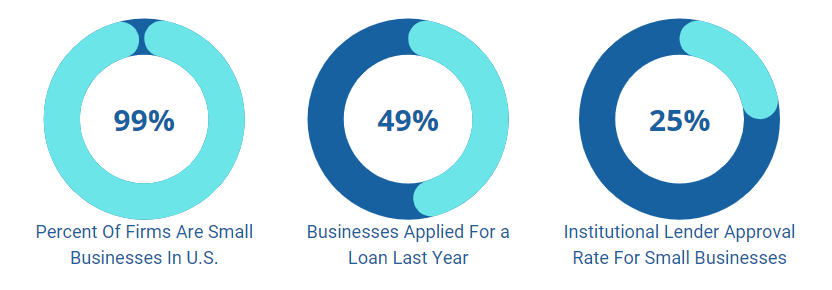

According to the SBA, the ability to access credit is vital for the survival and success of Small Businesses. With 99% of firms in the U.S. being a Small Business, and Institutional Lenders only approving less than 25% of their small business loan applications, Small Business Owners need another source of funding. Knowing the best online small business loans, and online Business Lenders, can be a great advantage.

49% of Business Owners have applied for a business loan within the last year. While over 60% have faced some type of financial challenge. To fill this gap, and help overcome these challenges, a majority of Business Owners have reported having to use their personal funds. While almost one third have reported having to cut staff, or downsize, to meet their financial needs.

Without the ability to access additional capital, it can be difficult for Business Owners to properly run or grow their business. Fortunately, to help fill this gap, there has been a significant increase in the number of online or alternative business lenders over the last several years. Since these are not large Institutional Lenders, or Banks that are lending out their depositors money, they have different underwriting criteria, and can often help get small businesses the money that they need.

High Approval Rates

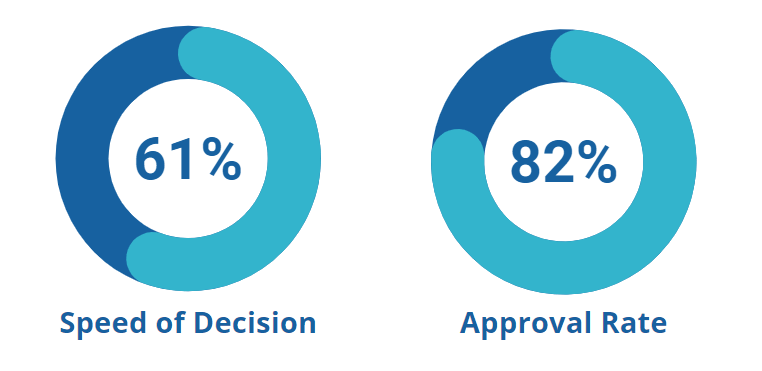

Over 61% of applicants with Online Business Lenders reported that their reason for applying for an online loan is because of the Lender’s ability to make a decision quickly. Because of a simplified approval process, these loans are often approved within minutes, and a lot of Online Business Lenders offer same day business funding. Not only does this save time in the application process, but it gives Business Owners the ability to access funding for their business quickly.

As long as the Business meets the minimum criteria, 82% of applicants for online business loans were approved for funding. This includes Business Owners that are considered to have high-risk personal credit. By basing the approvals primarily off of the qualifications of the business, not the personal credit of the business owner, it allows Online Business Lenders to offer funding to companies that would typically not qualify for traditional bank financing.

Banks vs. Online Business Lenders

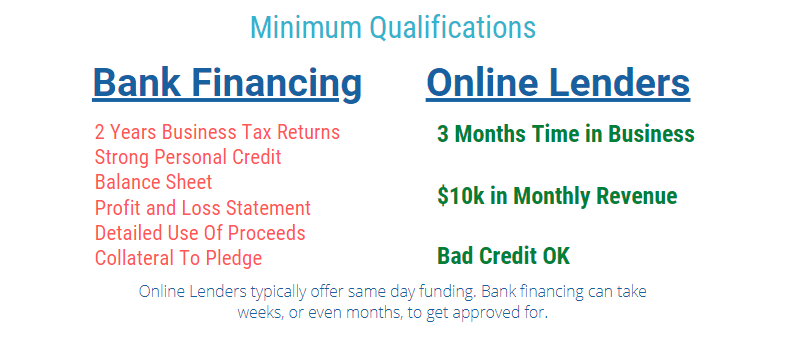

Most Banks require at least 2 years of full financial documents for the business (tax return, profit and loss, etc…), a strong personal credit score, sometimes a strong business credit score, and can also require some form of collateral to secure the loan. Every Lender has their own underwriting criteria, and these loans can often takes weeks or even months to get approved for.

If you meet all of the underwriting criteria for a bank loan, and don’t mind potentially waiting weeks to get approved, then a bank loan may be a better option. Because of the more strict underwriting criteria, the rates and terms tend to be more favorable with traditional bank financing. Rates are typically under 13% for traditional bank loans.

For an online business loan, these Alternative Lenders use different criteria to determine the credit worthiness of a business. Typically, the business just needs to do at least $10k per month in revenue, and have been in business for at least 3 months. By basing the approvals primarily off of the business’ revenue and time in business, it allows for a much faster turn around time, and a much higher approval rate. Most online business loans can be funded within 24 hours.

Depending on your situation, and the qualifications of your business, one of these options will make more sense for you. If you have bad credit, don’t meet all of the underwriting criteria for a traditional bank loan, or just need to be able to access funding quickly for your business, then an online business loan may be the better option.

Compare Loan Options

Get The Funding Your Business Needs

Every business is unique, and so are it’s financial needs. With a majority of businesses having faced some type of financial difficulty over the last 12 months, the ability to access funding, especially quickly, can be the difference between a business’ ability to succeed or their failure. Nearly half of the business owners that have had to shut down their business have said that it is due to a lack of funds.

Unexpected challenges and opportunities are part of the path of entrepreneurship. Whether it is an amazing opportunity to grow and expand your business, or an unexpected challenge that requires a quick business loan, Business Owners need to be able to access credit.

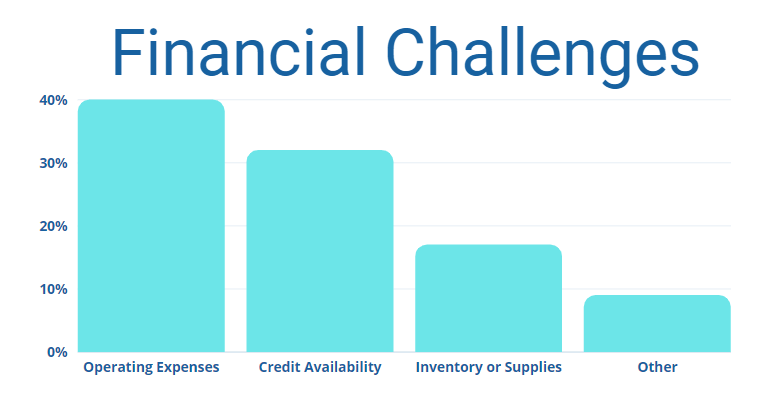

According to the Small Business Credit Survey by the Federal Reserve Banks; 40% of Business Owners have reported that covering general operating expenses is one of their biggest challenges. While over 30% have said that the availability of credit is the biggest financial challenge that their business has faced. Inventory, supplies, and other random business related expenses also create a financial challenge for a lot of Small Business Owners.

Types Of Online Business Loans

Business Line Of Credit

Revolving line of business credit. You can pull from as-needed, and only pay for what you use. As the funds are paid back, that money becomes available to borrow again. Great option for Business Owners looking to cover the gap in between receivables, or cover a short-term need.

Business Term Loan

Business term loans with terms up to 5 years. The programs have fixed payments and terms, making it easier to manage from a cashflow standpoint. These are great for business owners that are looking to finance a longer term need, such as a business expansion or large project.

Working Capital Loan

Working capital loans are a form of revenue based business loans, where the approval amounts are primarily based on a percentage of the business' monthly revenue. They are typically the easiest programs to qualify for, and are among the best choices for Business Owners with bad credit.

Invoice Factoring Loan

An invoice factoring loan allows you to take your unpaid invoices and turn them into quick cash for your business. By using the unpaid invoices as collateral for the loan, Lenders can quickly approve and fund these transactions. This is a great option for B2B companies with a typical payout of a net 30+ on their receivables.

If you are unsure which program will work best for your business, complete our easy online application, and our Underwriters can put together multiple options for you to review. Depending on what you are trying to accomplish, one program may make more sense than the others. There is no cost to apply, or any obligation to accept any offers.

Get Approved For Online Business Loan

Getting approved for an online business loan has never been easier. Not only is the process much more streamlined, compared to traditional bank financing, but the approval rate is also much higher. Over 90% of Business Owners that applied only with an Online Lender, were approved for at least some form of funding.

To get approved for an online business loan, you just need to take a few minutes to complete the easy online application, and provide your recent business bank statements to verify the business’ revenue. Once those are received, it can often just take minutes to get approved, and if the terms make sense for your situation, then most Online Lenders offer same day business funding.

31% of Small Businesses that have employees are growing. Meaning that they are either increasing their revenue, increasing the number of employees, or planning to increase their number of employees. This growth often requires additional funding to help cover related expenses. Such as payroll, insurance, and equipment.

If your business has a need for some additional funding, whether it is to help support the growth of your business, or just help get you through a cashflow crunch, you can complete our easy business loan application, and explore your options today.

There is no cost to apply, or any obligation to accept any offers that are made. If you have any questions, or need any assistance with the application process, please feel free to contact us, and one of our Representatives will be more than happy to assist.