Small Business Loans - What You Need To Know

As you are probably already aware, the ability to access a small business loan is often the lifeline that has the biggest impact for many small businesses. Small businesses are the backbone of the American economy, and account for over 65% of the new jobs created in the United States since the year 2000. Not only do they help create new jobs, but they also help keep money flowing through the economy. Their economic impact can be seen throughout small communities and large cities alike. They provide jobs, can help create competition for large corporations, and most money spent by small businesses ends up back in the communities they are located.

The challenge that many Small Business Owners face; is what to do when they need funding to help support and grow their business. For some, this means using their personal savings or even asking family, but for most, they would prefer some type of business funding. In this article we are going to take a deep diver into everything you need to know about small business loans. Including: what is a small business loan, what are the different types of loans, which Lenders offer these types of programs, and the factors that are taken into consideration by the Lenders that offer business funding.

What Is A Small Business?

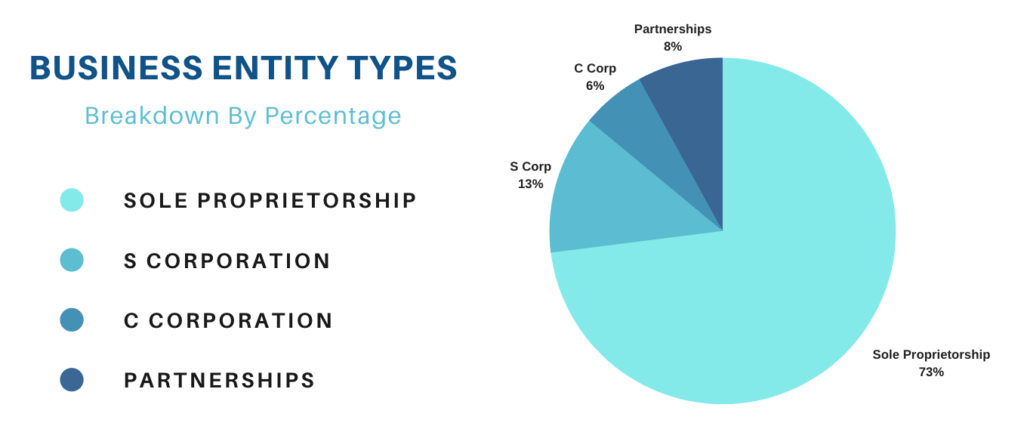

A Small Business is a for-profit organization that is located in the United States. Small businesses can be privately held companies, partnerships, or individually owned. There are several different entity types that a small business can be structured as. According to a report issued by Tax Foundation, Sole Proprietorships make up the largest percentage at over 73%. S Corporations and C Corporations, combined, made up another roughly 19%, while partnership accounted for approximately 8%.

According to the Small Business Administration (SBA), small businesses make up over 99% of the number of businesses in the United States, and they employ almost half of the total workforce. The Small Business Administration uses size standards to determine whether or not a business is a small business. The size standards take the annual revenue, the total number of employees, and the business’ industry all into consideration. In general, a business that does less than $40 million per year in revenue or has less than 1500 employees could technically be considered a small business by the SBA. For the purpose of this article, we are going to simplify the definition, and simply define it as a business that is not a large corporation.

Small businesses are not always competition to large corporations. There are times that they may work together, or cooperate, on providing a product or service. An advantage for a lot of small businesses is their ability to be flexible and pivot the business strategy quickly, since there are typically less people involved in the decision-making process. Other than the significant difference in size and revenue, one of the main differences between a small business and a large corporation is their ability to access funding for the business.

What Is A Small Business Loan?

As a Small Business Owner, at some point you may need to seek additional capital to help get your company off the ground, help get your business through difficult financial periods, or help provide you with the funds needed to properly manage and grow your business. Getting a small business loan is a way for a Business Owner to get the funding needed to help overcome any of these financial challenges. These business funding programs are typically intended for the funds to be reinvested in the business, and can often be used to help with most business-related expenses.

A small business loan is typically a form of business funding that is completed in the business name and associated to the business’ Tax ID or EIN (Employee Identification Number). Depending on the type of business loan, it may, or may not, require the Business Owner to also use their personal credit to help secure the loan. A business loan that is reported to the business credit can also help improve the credit profile for the business.

Small business loans have terms that can vary significantly depending on the type of loan the business is approved for. There are several different business loan options available, and several types of Lenders that offer these programs. To decide which small business loan will work best for your business, it is important to understand the different options, and the pros and cons of each. In an effort to help you better understand, we are going to review the different options available.

Different Types Of Small Business Loans

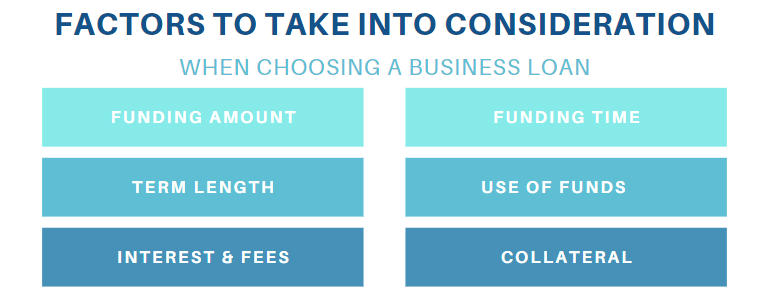

In order to choose the small business loan that will work best for your business, it is important to find the program that is the best fit for what you are trying to accomplish. Some factors that should be taken into consideration include: the amount of money that the business qualifies for, the term length (amount of time to pay the money back), the costs associated with borrowing the money, if there are any restrictions on how the money can be used, is the business loan tied to any collateral or the Business Owner’s personal credit, and how quick is the funding process.

As a general rule of thumb, the small business loans that offer the most favorable terms, are also typically the most difficult to qualify for. These programs can also take the longest to fund because of the more thorough underwriting process. For the fastest business loans, and the highest approval rates, it is typically best to work with an Alternative or Online Business Lender whose primary concern is the affordability of the loan payment. These online business loans tend to have less favorable terms, but can often be funded very quickly. Some even offer same day business funding.

There are many different types of small business loans available. To help narrow down which will work best for your business, we have covered some of the most common business loans currently available.

SBA Loans

An SBA loan is provided through private lenders and banks and guaranteed by the U.S. Government. The SBA offers several loan programs, including 504 loans, microloans, and 7(a) loans. SBA loans typically have more competitive rates, but can be more difficult to secure. The application process is more rigorous and lengthier when compared to the other loan options. It is up to the individual Lenders, but in general the Business Owner needs to have a good personal credit score (690+), and have some type of cash or collateral to put towards the deal. There can also be restrictions on how the funds are used.

A business term loan is a common type of business funding where a small business receives a lump sum of money upfront and pays it back over time with interest. This type of small business loan typically has a fixed term and fixed payment. There are several different types of lenders that offers these programs. The most common include banks and online business lenders. Depending on the Lender, the terms and amount of time it takes to receive the funds can vary. With Online Business Lenders, these programs can typically get approved for in a matter of hours, and funded very quickly. Because of the fixed payments and terms, these programs can often be easier to manage, and budget for, from a cashflow standpoint. Most business term loans can be used for almost any business-related expenses.

A business line of credit is a revolving credit line, similar to a credit card. This type of business funding allows Small Business Owners to access capital as needed. Once approved for a business line of credit, the business is assigned a max credit limit, and the Business Owner can pull from the credit line whenever they run into a need for funding. The terms of the credit line are going to be determined by the Lender that issues the funding. Typically, the fees and interest are calculated on the amount borrowed and the length of time it takes to pay off the balance. These revolving credit lines are a great flexible option for Business Owners who run into an unexpected or short-term need for funding.

Equipment Financing

Equipment financing for a business can be structured a couple of different ways. The two most common forms of business equipment financing are term loans and an equipment lease. The term loan option is similar to a normal term loan with fixed terms and payments. With an equipment term loan, the piece of equipment is used as collateral to secure the loan. For equipment leases, it is very similar to a consumer leasing a vehicle. In this case, the Lender technically owns the piece of the equipment, and the business essentially agrees to rent the equipment with predefined terms. Once the lease term is up, the Business Owner has the option to purchase the equipment for the “buyout” price, or turn the equipment back over to the lender. There are pros and cons to each program, and we recommend speaking with your tax advisor to see which option makes the most sense for your business. Both of these programs can be a great financing option for any business that needs equipment for their business. Equipment isn’t just considered machinery and vehicles, some lenders will also offer equipment financing for things like computers, furnishings, and other necessary equipment to run a business.

Invoice factoring, also known as AR (accounts receivable) factoring, is a practice where you “sell” your company’s unpaid invoices (accounts receivable) to a lender to quickly bring capital into your business. The Lender uses the unpaid invoices to secure the funding, and will typically use a percentage of the invoice amount to determine the loan amount. This can be a great option for businesses that have unpaid invoices, but need funding to take on additional projects or to help cover other business-related expenses. These small business loans can typically be funded within a few days. Since the invoice is being used to secure the loan, this can also be a good loan option for Business Owners that have bad credit. So if you need money quickly, have challenged credit, or just need to improve the cashflow of the business, this type of business funding may be a good option.

Cashflow business loans are a form of revenue-based business funding. The most common type of a cashflow business loan is a Merchant Cash Advance, but there are also other revenue-based loans that are structured similarly to a Business Term Loan with fixed terms and payments. The main factor in the approval process is the revenue of the business and the affordability of the payment. In general, both the payment and the funding amount are designed to match the cashflow of the business. Using this simpler underwriting process, these loans have the highest approval rate and can typically be funded very quickly. This product is most commonly offered by Online Business Lenders that offer alternative business funding products. For Business Owners that have bad personal credit, do not meet traditional bank criteria, or need money quickly, this type of business funding may be the best option.

For Business Owners that have never taken a loan out for their business, or are unfamiliar with the different funding programs available, it may seem a little overwhelming. The great thing about these different small business loans, is that each loan is designed to help solve a specific need. So, depending on the financial challenge or opportunity that your business is facing, there is likely a funding option that can help. Knowing the different funding options available puts you, as a Business Owner, in a better position to properly manage your business.

Factors Taken Into Consideration For A Small Business Loan

Banks, and other business loan lenders, look at several factors when determining the credit worthiness of a business. Most lenders have minimum requirements that need to be met in order for a business to even be eligible to apply for a small business loan. If the minimum requirements are met, then typically other factors will be taken into consideration for the lender to make a lending decision. If a business is approved, then these factors can also impact the terms and the amount of money that the business qualifies for. In general, the more favorable the funding terms are, the more stringent the underwriting criteria will be. As a Business Owner, it is important to understand these different factors in order to put your business in a better position to obtain credit when it’s needed.

Business Credit Profile

A business’ credit profile is a key indicator to a lender if the business can handle its debt obligations. There are several different Business Credit Reporting Agencies, and each has their own criteria that they use to determine the creditworthiness of a business. As a Business Owner, it is important to understand the factors that make up your business credit, and the things that can be done to improve the credit profile. According to a report by Nav.com, a Business Owner that knows their business credit score is over 40% more likely to get approved for a business loan. Some Lenders look more closely at business credit than others, but in order to get the best financing terms available, it is important to have a good profile.

For more information about Business Credit, see our article “Business Credit – Everything You Need To Know”

Personal Credit Score

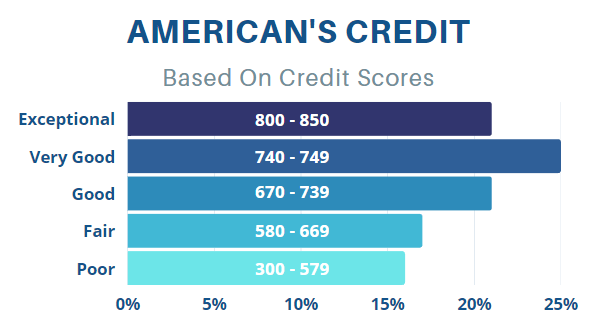

Depending on the Lender and the type of business loan you are looking for, a Business Owner’s personal credit can be one of the main factors taken into consideration in the approval process. Traditional financing with banks, and large financial institutions, typically have minimum personal credit score requirements in order for the business to be eligible for financing. For Business Owners that have bad credit, using an alternative business lender may be the best option. These lenders are less focused on the personal credit, and are more concerned with the qualifications of the business itself. If you are trying to get access to the best business funding programs available, it is important to have a good personal credit score. This shows Lenders that the business owner knows how to properly manage their debt, and lowers the risk from a lending standpoint.

Length Of Time In Business

According to a report a report issued by the Bureau of Labor Statistics, almost half of businesses fail within the first 5 years, roughly two-thirds fail within the first 10 years, and only approximately 25% of businesses survive for at least 15 years. Because of this, one of the main factors taken into consideration by most Lenders is the company’s time in business. For most large banks and financial institutions, they require at least 2 years of time-in-business in order to be eligible to apply for a business loan. For newer businesses, alternative or online business loan lenders can be their only option because of their less restrictive time-in-business requirements. Some of these Lenders will fund a business with as little as 3 months of time in business. In general, the longer a business has been around, the lower the risk, and therefore more favorable financing terms.

Annual Revenue

As is the case with most loans, affordability is one of the most important things that Lenders take into consideration when reviewing an application for a small business loan. To determine the affordability, most lenders will look at the annual revenue of the business. Most Lenders have a minimum monthly, or annual revenue, in order for the business to be eligible to apply. For example; most revenue-based business loans require a minimum of $10,000 per month in gross revenue. For most business loans, the amount the business is approved for is going to be relative to the gross annual sales. The higher the revenue, the larger the funding amount.

Secured Or Unsecured

There are primarily two types of small business loans, secured and unsecured. Some lenders, or loan types, require that the Business Owner pledges collateral to secure the loan in the event of default. These types of business loans are considered secured. The collateral helps lower the risk from a lending standpoint, and can be used to help secure financing. An unsecured loan doesn’t require collateral to be pledged, and is therefore riskier for a lender. Because of that, most unsecured loans tend to have less favorable terms, compared to secured business loans. The benefit to an unsecured loan for a Business Owner, is that in the event of default, they do not risk losing other assets. Whether a loan is secured, or not, is something that should be taken into considerate for both the lender and the business owner.

Small Business Loan Providers

There are several different types of lenders that offer small business loans. Each lender has their own funding products and their own underwriting criteria. As a Business Owner, it is important to understand the different options that are available, and the best place to start is knowing the different types of lenders that offer business funding. Depending on the business’ qualifications, and the goal that is trying to be accomplished, working with one type of lender may make more sense than the others.

Large Banks & Financial Institutions

By definition, large banks and financial institutions have access to larger amounts of capital. Which gives them the ability to fund larger projects and business needs. Because of the size of these companies, there is typically general underwriting criteria that needs to be met, and the criteria if often more stringent than other business loan providers. Although these lenders can typically offer larger funding amounts, they can also be more difficult to qualify for, and they typically do not have the same level of flexibility as some of the other lenders. For larger, more well-established businesses, that are looking for larger amounts of business funding, working with this type of lender may be a good option.

Small Community & Local Banks

Small community and local banks typically have similar underwriting criteria to larger financial institutions, but tend to have more flexibility in their approval process. Since there are typically less people involved in the underwriting process, and a more personal relationship with the Business Owner, it can be easier for a small bank to make funding exceptions when necessary. This helps give them the ability to offer funding to businesses that may not otherwise get approved with a large financial institution. For a small business owner that is looking for the type of business loans offered by large banks, but may not meet the stricter underwriting criteria, or is looking for a more personal relationship with the Lender, working with a small bank may be a good option.

Alternative & Online Business Loans

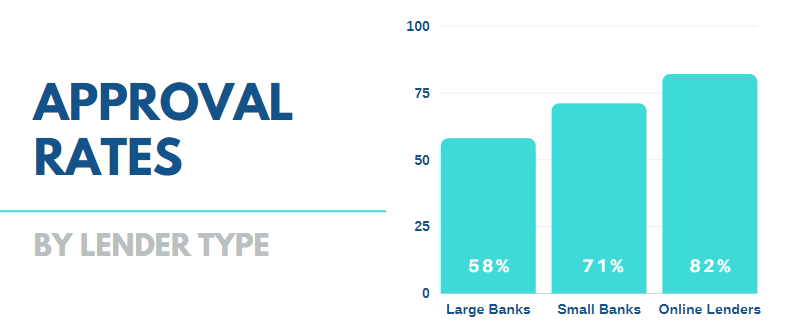

These lenders are becoming a common lending solution for small businesses. These lenders typically do not have the same, more stringent, underwriting criteria as traditional banking institutions. Not only do these lenders have a much higher approval rate, but they are also a great option for when a business needs a quick business loan. By using the qualifications of the business, and basing the approvals primarily off of the affordability of the loan, the approval and funding process are typically much simpler. This also allows them to offer a business loan to Business Owners with bad credit. According to an article by Forbes, “non-banks lenders are a viable source of capital for small business owners”. Although the terms may be less favorable than traditional bank financing, these alternative business loans can be a great funding option for many small businesses.

No matter which type of lender you choose to work with, there are benefits to establishing a relationship with a lender. Having a positive payment history can help build the business credit profile. Which can help with getting access to more favorable terms, and possibly larger funding amounts, for future business loans.

In Conclusion

Taking out a small business loan can be a big decision for a Business Owner. Depending on the situation, it can be a stressful moment where cashflow is tight and money is needed to help the business survive, or an amazing new opportunity that the additional funding will help take the business to the next level. Either way, knowing the different business loan options available, where to get the funding from, and what factors are going to be taken into consideration for the approval process, all put a Business Owner in a better position for making the right decision for their business. Not only can it help cutdown on the amount of time it takes to get funding, but choosing the correct type of lender and business loan can also help cut down on unnecessary finance charges. Be sure to do your homework, and choose the option that will work best for your business.