Best Way To Get A Quick Business Loan

Over 60% of Applicants are applying for a business loan because the need capital quickly. Knowing the best way to get a quick business loan can make the difference in a business’ ability to succeed.

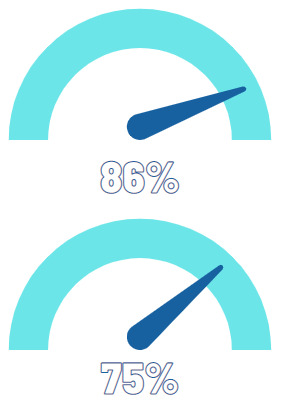

86% of Business Owners report that they have experienced financial challenges in the past 12 months.

75% of which took additional funding to help overcome their challenges.

Bank loans can takes weeks, sometimes even months, to get approved for, and only approve less than 20% of their business loan applications. Banks typically have much more strict underwriting criteria, usually require a strong personal credit score, and possibly some form of collateral.

For Business Owners that need money quickly, or have bad credit and do not meet the more strict underwriting criteria, a traditional bank loan isn’t an option. Luckily, there are Online Lenders that specialize in providing quick business loans.

These Online Lenders base their approvals primarily off of the qualifications and cash-flow of the business, and have simplified the application process. By eliminating a lot of the documentation, it typically only takes minutes to get approved, and only hours to get funded.

Quick Business Loan Options

Working Capital

A Business Working Capital Loan is a short-term, revenue based loan that is a great option for Business Owners that have bad or challenged credit.

Term Loans

A Business Term Loan typically has a fixed funding amount, with fixed terms, and can be used for any number of business expenses.

Line of Credit

A Business Line of Credit, is a revolving credit line for your business. Like a typical line of credit, you can pull from the credit line as-needed.

Compare Loan Options

If you would like to compare loan options, complete the easy online application, and our Underwriters will put together some options for you to review. There is no cost to apply, or obligation to accept any offers.

How Can The Money Be Used?

These quick business loans can be used for any related business expenses. Anything from covering your payroll, to purchasing inventory. You can use the funds however you see best fit.

Common Uses For A Quick Business Loan

- Covering Payroll

- Purchasing or Fixing Equipment

- Marketing & Advertising Budget

- Purchasing Inventory and Supplies

- Business Renovations

- Paying Taxes & Insurance

Qualifications For a Quick Business Loan

These quick and easy business loans are designed to help businesses of all types. Including newer, less established, businesses. If your Business meets the following criteria, you are eligible to apply:

- 3 Months Time In Business

- Minimum Of $10k In Monthly Revenue

The easy online application only takes a few minutes to complete. Once the application is complete, simply provide the most recent business bank statements to verify the business’ revenue, and you can get approved in minutes. If the terms make sense, you can get funded today.

Please feel free to reach out if you have any questions, or if there is anything we can do to assist.