Business Credit - Everything You Need To Know

Are you a Business Owner wondering what is business credit, and what is everything you need to know? A positive business credit history is a must in order for a Business Owner to be able to obtain the best forms of business funding. By accessing the best financing options, it allows a Business Owner to cut down on unnecessary interest and financing charges, which can help improve the profitability of the business.

From the moment you start your business, and continued throughout your journey as a Business Owner, creating a strong business credit profile can help you increase profit and add to the overall bottom line. For a new Business Owner, it’s very important to establish a positive business credit profile to build trust between the different Vendors and Lenders that you will work with. Well-established business credit can not only help you obtain credit accounts with your Vendors, typically on a net 30-60 terms, but it can also help develop a relationship with a Lender that can get you access to quick business loans when needed, or business loans with more favorable terms. Strong business credit can also help Business Owners with bad personal credit get the financing that they need by using the business credit to determine the credit worthiness, and ultimately having the business obtain

its own financing. Even for Business Owners that have a good personal credit score, often the goal is for the business to finance itself, and create the separation between personal and business finances.

If business credit is a new concept to you, or you are just trying to learn more, there is no need to worry. We have got you covered in this article. We are going to take a deep dive into the details about business credit. What are the different types of business credit? How is it beneficial to have a good business credit profile? How does your business credit score affect your ability to obtain a business loan? How to use your business credit to access capital quickly for your business? And many more things that are necessary for you to have a better understanding of how business credit works, and what you can do to help set your business up for success.

What Is Business Credit?

Business Credit is a lifeline for any business. It means that a company can buy something now and pay for it later. This can range anywhere from purchasing inventory, to covering payroll. Credit can be used to cover almost any business-related expenses. Whether it is by building trust, and getting credit from their vendors, using business credit cards, or working with banks or other online business loan lenders to obtain funding. When a business has access to business credit, it can help provide the opportunity to grow and expand your business. It can also help get your business out of a bind in a situation where cashflow is tight. One of the main keys for any successful business is a strong business credit profile, and the ability to access capital when needed. Having a good business credit score and profile is a sign to your creditors that you are managing your business properly, and are capable of paying back your debt. Which, in turn, makes them more comfortable providing credit to your business.

Therefore, in any business, it is very important that the Business Owner understands how business credit works, and what you can do to help improve your business’ credit worthiness. There are specific things that can be done to improve the credit of a business, and improve the odds of getting a small business loan, and/or other forms of business credit. This includes things such as; Building a good relationship with your vendors to establish vendor credit. Establishing a payment history for more traditional bank business loans that report to your business’ credit reports in order to boost your business credit score and profile. Also, with a lot of the alternative and online Business Loan Lenders, cashflow can be the main factor in qualifying for a fast revenue-based business loan. For newer, less established businesses, it may be necessary for the Business Owner to also use their personal credit and provide a personal guarantee to help start establishing some credit in the business’ name.

Types Of Business Credit

When you are thinking about how to set your business up for success, you may wonder that what type of credit account to open for establishing a strong business credit profile. Below we are going to cover 5 of the most common forms of business credit and business funding. Depending on what you are trying to accomplish, and the qualifications of yourself and/or the business, one option may make more sense for your situation. For a lot of successful businesses, they often use a combination of the different forms of credit listed below to help with cashflow, and support the growth of the business.

Vendor Accounts

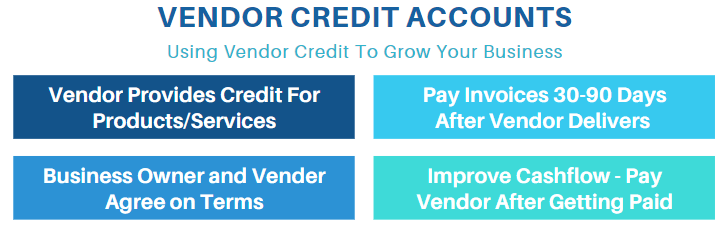

A Vendor Account is an account that you establish with your vendors and/or suppliers. Not all vendors offer credit to their customers, but for those that do, this can be a great way to help improve the cashflow of the business and can be a great tool to help grow your business. With this type of account, your company will pay the cost after you have already received the services and/or products. Vendor accounts are typically on a net-30. Which means they will give you up to 30 days to pay off your balance for the products or services received. Once a business has established a solid relationship with a vendor, and depending on the vendor, there are sometimes also options for a net-60 to net-90 terms.

Vendor accounts can be a great option for businesses that are looking to purchase inventory, purchase materials, or subcontract work for their projects. This gives the Business Owner the opportunity to sell the inventory, or complete the project, before having to pay their Vendors. Which can help with the overall cashflow of the business.

To see if your business is eligible for a vendor account, you need to speak with your vendors and see if that is something that they are willing to offer. Since it is the vendor giving the credit, they ultimately get to decide who they give credit to, and what the terms will be. Some may require some type of personal guarantee.

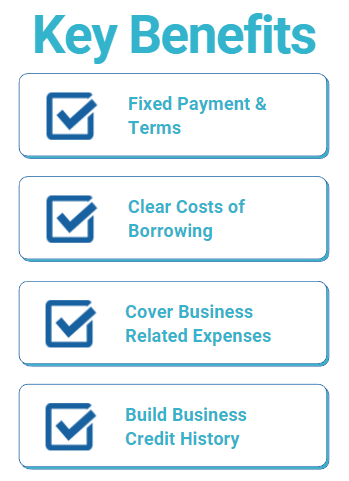

A Business Term Loan or Installment Loan is typically a form of business funding that you will obtain through a bank or large financial institution that offers small business loans. There are some alternative or online business loan lenders that also offer this type of financing. This type of business funding typically has a

predetermined funding amount and terms. You can use a business term loan for anything ranging from expanding your business, purchasing equipment, to helping consolidate other debt with less favorable terms. These programs typically have a predetermined funding amount, with fixed payments and terms. Not only does this make it easier to forecast and budget your monthly expenses, but it also gives you a clear understanding of what your cost of borrowing the money will be upfront. It depends on the program, and the Lender that you are working with, but typically these business loans will also report to your business credit. Which, assuming a positive payment history, can help you build your business credit profile and score.

There are many different types of business term loans and

installment loans available. Depending on the type of loan you are looking for, and the lender that you are working with, the terms can vary pretty significantly. Depending on what you are trying to accomplish, along with your business credit, personal credit, and qualifications of the business, there may be a specific Lender or funding program that will work best for your business.

Revolving Business Credit Lines

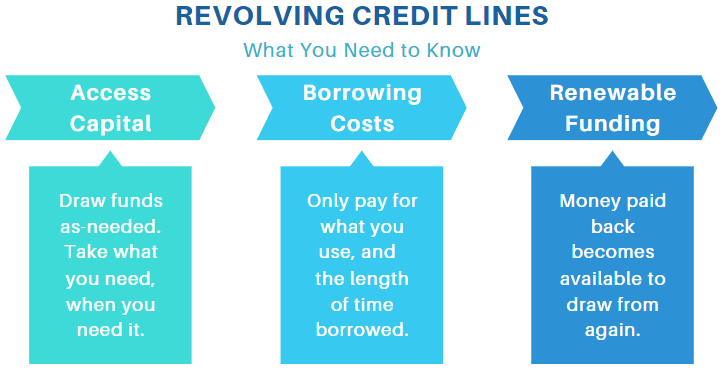

A revolving line of business credit ban be very useful for most businesses. What makes it a revolving credit line, is the ability to draw from as needed. The creditor will issue a max credit limit. You can pull from the business credit line as needed, and as you pay the funds back, those funds become available to borrow again. This can be very useful for a Business Owner that is looking to finance a short-term need.

There are primarily 2 different kinds of revolving credit lines for a business. The first is a business credit card, and the second is a business line of credit. A business credit card is essentially the same thing as a personal credit card, but the account is in the business name. A Business Line of Credit is a form of business funding that is typically issued by a bank or financial institution, and is a preferred form of funding for a lot of Business Owners. Typically, there is a max credit limit assigned to the business, based on several factors. Including: your business credit score, the personal credit of the business owner, and the time-in-business and revenue of the business.

With a credit card, you have different payback options. It doesn’t require you to pay the full amount back at once. You have the option to only pay the minimum amount. If you don’t want to get hit with interest charges, then you pay the full monthly amount. When you pay the money on time, you can eliminate costs of borrowing.

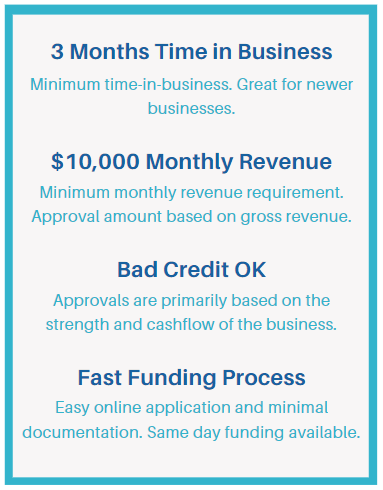

A Revenue Based Business Loan is a form of business funding that is primarily based on the monthly revenue and cashflow of the business. Instead of making a lending decision based on the criteria that a traditional lender will use, these Alternative Business Lenders (Online Business Loans) will typically use the revenue of the business to determine the credit worthiness and the ability of the business to repay the loan.

There are several different types of cashflow business loans available. The most common include: merchant cash advances, short-term working capital loans, revenue-based business term loans, and a revenue-based business line of credit. Although these programs are easier to qualify for, and have a significantly higher approval rate compared to traditional bank financing, they also tend to be more expensive.

Since it can be very difficult, if not impossible, for newer, less established businesses to qualify for a business loan with a bank, cashflow business loans have become very common to use. There are quite a few companies that offer business loans online that

specialize in this type of funding product. Every Lender has their own criteria, but in general, the business just needs to have been established for at least 3 months, have a business bank account, and be depositing a minimum of $10,000 per month in order to be eligible to apply. This can be a great option for Business Owners that have bad/challenged credit, or for companies who have not yet built up their business credit.

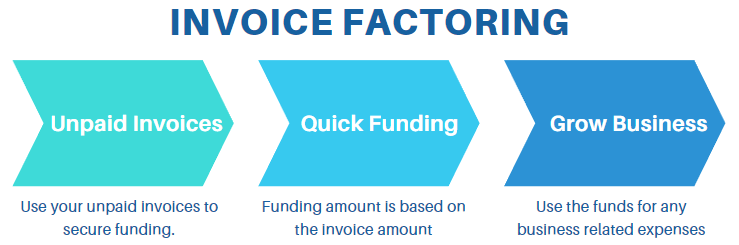

Invoice Factoring Business Loan (Accounts Receivable Loan)

An Invoice Factoring Business Loan, or Accounts Receivable Loan (AR Factoring), is a form of business funding that allows you to take your unpaid invoices, and turn them into a quick source of capital for your business. Typically, for this type of business funding, the Lender will purchase your unpaid invoices at a discount. This eliminates the time between when your service/product is delivered, and when your business receives payment. Which gives you the ability to fund your next project, or cover any other expenses that your business may have.

There are several benefits to using an Invoice Factoring Business Loan. Some of the most common reasons that Business Owners will go this route are; easier underwriting guidelines, fast funding process, bad credit is OK, and it is a renewable source of funding. As the invoices continue to come in, you can continue to turn them into funding for your business. Instead of passing on opportunities, or delaying projects, these business loans can be a great tool to help expand your business.

Difference Between Personal & Business Credit

As a Business Owner, it is very important to understand the difference between business credit (the credit worthiness of the business), and the personal credit of the Business Owner (the credit worthiness of an individual). The business credit profile is tied to the Tax ID (Employee Identification Number) of the business. While personal credit is tied to an individual’s social security number. There are some key differences between the two, and both can affect the ability of a business to obtain credit.

An individual’s personal credit score and credit report is determined by the 3 different Credit Bureaus; Transunion, Equifax, and Experian. Each has their own scoring model, but in general the scores can range anywhere from 300 – 850. A “good” personal credit score is considered to be anything above a 670. Although the goal is to separate the personal from the business finances, there may be situations where your personal credit is taken into consideration. For some business funding programs, this can have an impact on whether or not the business is approved, and the terms that it has access to. Having a strong personal credit score can show a Lender that a Business Owner is responsible with their personal finances, and can properly handle their credit. The higher an individual’s personal credit score is, the lower the risk is from a lending standpoint. Because of this, Business Owners with a strong personal credit history, and profile, tend to get access to more favorable terms when their business needs funding.

A business credit score and profile aren’t quite as simple. There are several different business credit reporting agencies that keep track of a business’ credit history and profile to help determine the credit worthiness of the business. Three of the most common business credit reporting agencies and their scoring model include; Dun & Bradstreet has their PAYDEX score, Experian uses their Intelliscore, and Equifax has their Business Delinquency Scores. Each company has their own criteria that they look at, and there isn’t a uniform scoring model, unlike an individual’s personal credit. In general, some of the main factors taken into consideration when determining the credit worthiness of a business are: the age of the business, the payment history for previous business loans and credit, the size of the company in both revenue and number of employees, and the industry of the business can also be taken into consideration. Some industries are considered to be higher risk than others due to potential regulatory issues, inconsistent cashflow, or just the inherit riskier nature of a specific industry.

For both your personal credit and business credit, payment history on previous loans and/or credit is one of the biggest factors. In order to maintain and build a strong personal and business credit score it is important to establish a positive payment history with creditors. It is also very important to monitor your credit reports for both types of credit. According to Forbes, 34% of Americans found mistakes on their personal credit reports. While, according to a survey by the Wall Street Journal, 25% of Small Business Owners that checked their business’ credit found some type of error. These types of errors can ultimately end usp costing individuals and small businesses a significant amount in finance charges. Building and maintaining your personal and business credit requires financial discipline and effort on the part of the individual and/or business owner.

Benefits Of A Good Business Credit Score

Without business credit, or not enough business credit, it may be more difficult to compete in the marketplace. Especially if your competitors have access to credit, and your business does not. Having access to a quick business loan when your company needs it, or being able to pay your Vendors after you have had an opportunity to sell or collect on the product they sold you, can give you the leverage that your business needs to go to the next level.

It is also important to establish business credit as a way to limit your risk personally as a business owner. It is always best to hope for the best, but plan for the worst. If a Business Owner is having to personally guarantee all of their business financing; in a worst-case scenario, creditors could come after the Business Owner’s personal assets and have a negative impact on their personal credit.

Your business credit history is not just a way for lenders to determine the credit worthiness of the business. It can also have an impact on other areas of the business, such as insurance, and the lease on your business location. Both of which can be among the largest expenses for a lot of companies. Building a strong business credit profile is an investment in the future success of your business. Which, if managed responsibly, can tremendously add to the overall bottom line over the lifetime of a business. .

5 Stats That Show The Importance of Business Credit

Although it may be impossible to predict when exactly you are going to need a fast business loan, knowing the stats can help put you in a better position to be prepared for whatever comes your way. Knowing the odds allows you to better plan for the challenges and opportunities that your business may face. Below we have gathered some key statistics, from different sources, to help show the importance of establishing business credit:

46% Use Personal Credit For Business Expenses

According to research that was conducted by MasterCard, 46% of Small Business Owners have had to use their personal credit cards to help cover business expenses. Which means that nearly half of the Business Owners in the United States fail to separate their personal and business finances. Therefore, increasing their risk personally.

60% Of Businesses Faced Financial Challenge

Over 60% of Businesses reported having some type of financial difficulty within a 1-year timeframe. As a Business Owner, this means that more than likely your business is going to have to overcome some type of financial challenge at some point in time. A financial challenge isn’t necessarily always a bad thing, it can also mean lacking the business credit necessary to grow your business. Having access to business credit can be the key to overcoming these challenges.

6-18 Months To Build Better Business Credit

Depending on the business, and the level of effort the Business Owner puts in, it can take anywhere from a few months, to a couple of years to establish and improve your business credit profile. As reported by CardHub, small businesses need approximately 12 to 18 months to build a better business credit score and profile. This means, the sooner you start working on building your business credit, the better. With payment history being one of the main factors, that is a good place to start.

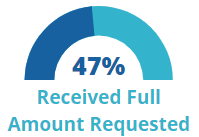

47% Received Full Amount Requested

According to the Small Business Credit Survey by the Federal Reserve Banks, only 47% of Businesses that applied for a business loan received the full amount of funding that they were looking for. Which means they either still lacked the funding needed, or they had to find another source of funding to fill the gap. For some, this means using their personal funds, or borrowing from friends and family. For businesses with an established, positive, business credit history, they can often fill the gap by using another source of business funding.

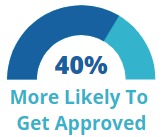

40% More Likely To Get Approved

According to the Nav American Dream Gap survey, almost half of the Business Owners in the United States are unaware that they have a business credit score. While that same report found that for Small Business Owners who are aware of, and understand, the importance of a strong business credit profile are more than 40% more likely to get approved for a small business loan. This means simply by having a better understanding of how business credit works can help give your business the competitive advantage needed to succeed.

Bottom Line

Building a strong business credit profile can have many benefits. It can help allow a Business Owner to separate their personal and business finances, get a small business loan, and help lower other business-related expenses. Such as business insurance and the lease terms for the business location.

Having a good business credit score and establishing a positive relationship with your Vendors and Creditors, can give you the ability to access several different types of business credit. By leveraging vendor credit, business term loans, business lines of credit, and business cashflow loans, you can take advantage of any opportunities that become available. Some opportunities and/or challenges require the ability to access capital quickly, and there are Online Business Loan Lenders that specialize in fast business loans that are not reported to your personal credit.

Owning a business can be full of fun and exciting new opportunities, but more than likely your business will run into some unexpected challenges along the way. Whether it is a new opportunity to expand your business, or an unforeseen challenge, the ability to access business credit quickly can be a key component of the overall success of your business. Get started building your business credit today!